Click here for the Top 12 Local Programs table. Find the table and the story in the Nov. 2011 post.

Farmland Preservation Report editor Deborah Bowers is now a fulltime employee of Carroll County (MD) Government, working with Ralph Robertson managing that county’s legendary farmland preservation programs, including one of the most innovative IPA programs in the nation, as well as the nation’s oldest Critical Farms Program. Farmland Preservation Report will continue to be posted, but there will be changes in frequency, cost, and content to be announced.

Proposed change in lending practices would help farm entrepreneurs

BY DEBORAH BOWERS, Editor

Proposed rule change could help specialty crop producers like the Zilke CSA in Milan, MI (Zilke photo)

Andrew Klein’s grandparents opened their first supermarket in 1925 in a rural Harford County, Md. community. Since then the Kleins have built six more stores and over the decades have become known for low prices, community support and a focus on locally grown produce. Now the family is building another supermarket, but not in the type of community it has located in before. Their newest project is in a northwest Baltimore neighborhood that is predominantly African-American where the need for low prices and fresh, locally grown produce is critical.

Klein was among those invited to the White House July 20 by First Lady Michelle Obama who recognized Klein and his son and others from across the country who are locating new grocery stores in “food deserts” – urban neighborhoods that have been shunned by major grocery chains and especially lack fresh and whole foods.

“The commitments you are all making today have the potential to be a game-changer,” said Mrs. Obama. “Parents should have fresh food retailers right in their communities — places that sell healthy food at reasonable prices.”

Fresh food: a sight unseen in America's 'food deserts'

“Lack of access to fresh food has been a silent problem for years,” said Andrew’s son Marshall Klein, at the ceremony. “It is one of the single largest factors determining family health, and the Klein family is excited to be a part of the effort in helping to make a difference,” he said.

Michelle Obama’s tribute to companies braving food deserts coincides with a proposed federal farm credit lending policy that, if adopted, could also be a game changer in how food is produced, who is able to produce it and where. The Farm Credit Administration (FCA), which regulates the Farm Credit System, wants loans to stretch further in terms of what is considered a farming enterprise and who is a qualified borrower. The FCA, in a policy proposal, has concluded that the 84 borrower-owned and locally controlled lending associations aren’t doing enough to meet their federal mandate to deliver financing and “related services” to young, beginning and small farmers, many of whom want to enter the “fresh and local” marketplace, according to Chicago-based ag finance consultant Robert Heuer and Michigan writer Patty Cantrell who teamed up to write about the potential changes that could result if the new rule is adopted.

According to Heuer, “FCS is an indispensable industry asset. But outside of the industry, it is an enigma. Many small-scale and potentially creditworthy producers don’t understand the System’s mission, let alone its statutory requirement to serve all segments of agriculture.

Heuer said FCS’ public purpose isn’t simply to supply credit; Congress also expects it to deploy “related services.”

“More and more consumers want to know how food is produced, where and by whom,” Heuer said. “FCS should view the demand for food sourced from nearby farms as more than just a new market and an opportunity to book new loans. This is a teaching moment that could lead the general public to gain a better understanding of the importance of having agriculture around.”

In 2010, FCS institutions owned $231.3 billion in total assets and generated a $3.49 billion profit. Some of that money should be channeled to the entrepreneur-based local food networks that are struggling for a foothold in the mega-food world, Heuer said.

“Farming that can supply food deserts is a market opportunity that Farm Credit needs to link to.”

National Sustainable Agriculture Coalition policy director Ferd Hoeffner says Farm Credit, which supplies nearly 40 percent of all U.S. farm financing, “has the capacity to bring badly needed capital to local food producers, and to leverage other sources of capital for the task of rebuilding our local and regional food system infrastructure.”

The FCA’s proposed rule states the Farm Credit System (FCS) must “commit to embracing diversity and inclusion in lending, employment and governance” or “risk losing…relevance in the marketplace.” If approved by the FCA board, every FCS institution would be required to create plans to diversify their workforce and market services to all potential “creditworthy and eligible borrowers.” The public comment period ended July 25.

Former NY farmland protection chief Cosgrove investigated for corruption

BY DEBORAH BOWERS, Editor & Publisher

ALBANY, NY – A report by the New York State Inspector General released July 7 concludes that former agriculture deputy commissioner Jeremiah “Jerry” Cosgrove directed his office to alter program awards to benefit a land trust that employed his wife Judith Anderson as a consultant. The report detailed the testimony of Cosgrove’s subordinates that Cosgrove compelled them to alter grant eligibility criteria in 2009 in order to award $100,000 to the New York Agricultural Land Trust (NYALT). The report noted that the grant funds “would have helped NYALT pay Anderson’s consulting fees.”

Cosgrove at an agri-economics conference in 2009 (Photo by Lee Publications, NY)

Cosgrove, who was fired in October 2010 when the allegations first came to light, was northeast regional director for the American Farmland Trust for 15 years beginning in 1992. He became deputy agriculture commissioner in 2007.

New York’s farmland preservation program operates by awarding grants to land trusts who initiate and process agricultural conservation easement purchases approved by the state. The grants in question were awarded through the New York Land Trust Grant Program, a separate program developed by Cosgrove as deputy commissioner that gives grants for land trust development including hiring new staff and increasing paid hours for existing staff.

According to the report, when Cosgrove was told by his staff that NYALT was not eligible to receive funds under the New York Land Trust Grant Program, he “pressured his subordinates to alter the agency’s established application review process and conduct a second round of scoring.” One witness said Cosgrove threatened to fire staff if NYALT did not receive a grant. Staff also increased grant funds for the 2009 round, under Cosgrove’s urging, in order to assure there was enough funding for the grant to NYALT.

The inspector general’s report also revealed that Cosgrove’s wife’s employment with a land trust was reviewed by an ethics panel at Cosgrove’s request in 2008 when he became deputy commissioner. But, according to the report, Cosgrove provided the panel with “inaccurate information and omitted critical details.” Cosgrove also “failed to disclose significant facts regarding his role in a contract between Agriculture and Markets and his former employer the American Farmland Trust. Further, Cosgrove omitted “crucial details” about his wife’s employment with NYALT, which had several matters pending in the Farmland Protection Implementation Grant Program, which was then under Cosgrove’s supervision. With incomplete information the ethics panel concluded Cosgrove’s employment as deputy commissioner and his associations with AFT and NYALT created no conflict of interest.

Cosgrove’s work with his former employer, the American Farmland Trust, “created, at a minimum, the appearance of impropriety,” the report stated “and at times presented an actual conflict of interest between Cosgrove’s state duties and his involvement with his former employer.” Cosgrove worked “on both sides” of a contract that paid AFT $50,000 for consulting services and he personally renewed that contract with AFT, the report stated.

According to the inspector’s report, Cosgrove admitted that he should not have been involved in the approval of separate legislative grants to NYALT. “Clearly…I shouldn’t have been signing off on the contracts,” Cosgrove told investigators. He said the contracts were sent to him in error as part of the agency’s contract management system.

In a statement on a land trust list serve, Cosgrove denied the allegations in the report, saying he kept his superiors completely apprised of his work and the nature of Anderson’s employment.

“I stand by the decisions I made. I deny that I ever threatened the employment of any staff member at the Department of Agriculture and Markets. As far as the decision to revisit the Land Trust Grant awards and increase funding for the program in 2009, I made that recommendation to the Commissioner for policy reasons. The Land Trust Grant program was designed to build capacity for those land trusts who were carrying out the state’s farmland protection projects, rather than the state incurring those costs,” Cosgrove stated. He further said that rescoring and increasing funding in the 2009 application round was a process that was reviewed and approved by his superiors even after his role in the process was questioned.

The Inspector General is referring the investigative report to the Albany County District Attorney and to the state ethics commission.

Pennyslvania amends program law to end buyback clause

BY DEBORAH BOWERS, Editor & Publisher

Pennsylvania farm (FPR photo)

HARRISBURG, PA – Pennsylvania has joined Maryland in amending program law to erase its 25-year buyback clause. The amendment to the Agricultural Area Security Law will become effective 60 days following the governor’s July 7 signature. The law is not retroactive, so easements purchased up to that date will not be affected. The program’s first easements were purchased in 1989, making requests for termination possible in 2014.

“I believe repeal of the 25 year provision will help safeguard a vast investment in farmland preservation made by Pennsylvania taxpayers,” said Doug Wolfgang, director of the Pa. Farmland Preservation Bureau.

Pennsylvania program officials for many years believed the program’s legal foundation was strong and there was little chance the permanence of easements would be challenged. But following Maryland’s action, it seemed to make sense to follow suit.

In 2004 the Maryland legislature ended the buyback clause in its program law. Easement language up to that time stated “This easement shall be in perpetuity, or for so long as profitable farming is feasible on the Grantor’s land.” The language, part of the original law creating the program, was meant to soften anxiety at the time over the permanence of easements.

Pennsylvania’s clause allowing for termination differs from Maryland’s in that the provision enable’s the Commonwealth and a county, not the landowner, to seek termination with the approval of the county and state boards. Still, the provision has long been seen as problematic and out of sync with program goals.

If an easement termination in Pennsylvania was attempted, the request would go first to the county agricultural advisory board, then to the county governing body, then to the state board and finally to the governor’s office, rather than to the legislature, as in Maryland. The IRS would become involved when landowners claim charitable deductions. Most easements in Pennsylvania are bargain sales with the average donation of about 20 percent.

A Harford County, Md. easement was the target of an IRS inquiry in 2010 (FPR photo)

In 2010 the IRS filed in U.S. Tax Court a motion for partial summary judgment in the case of a Maryland couple who sold an easement and claimed an income tax deduction for a charitable donation. The IRS was not disputing the donation, but the quality of the easement, claiming it was not perpetual due to the buyback or escape clause. The easement had been signed two weeks before the effective date of the legislative change. The IRS claimed the clause created “a condition for termination of the easement,” but eventually withdrew its case (see FPR Jan. 2010).

Other states have some form of escape clause, including Delaware, Ohio and Michigan.

Delaware’s process renders the possibility of termination nil, in that a request for review for possible termination would be successful only if a Land Evaluation and Site Assessment (LESA) score rendered the property unfit for agriculture. Then, it would be the state farmland preservation board that would make the decision following a public hearing. According to former program director Mike McGrath, who retired June 30, the IRS reviewed the Delaware easement language and approved it when the program was established.

Easements under the Michigan Farmland and Open Space Preservation Program contain a clause that allows for buyback of an easement if the land is rendered not farmable. No attempts had come forward as of early 2010. The program began operating in 1980.

The Ohio Farmland Preservation Program’s deed of easement states it is in perpetuity but provides for termination if it is determined that “an unexpected change in the conditions of or surrounding the land” subject to the easement “makes impossible or impractical the continued use of the land for the purposes described.” The program began in 1999 and to date no requests for termination have been made.

Other amendments signed into law include the allowance for underground mining of non-coal minerals and the addition for a definition for ‘contiguous.’

Pennsylvania program law does not prevent preserved farms from entering into leases for oil and gas extraction. Dozens of preserved farms have done so in the Marcellus shale gas drilling regions of the state.

Lot rights issue crops up again in Maryland

BY DEBORAH BOWERS, Editor & Publisher

A preserved Maryland farm (FPR photo)

ANNAPOLIS, MD – The Maryland Agricultural Lands Preservation Foundation board of trustees in June approved the work of its legislative committee, which has been reviewing needed changes to program policy and practice that must come by way of the legislature. Those include eliminating the last remnants of the program’s District agreements, tweaking the process for easement termination requests that may come forward from the 25-year buyback clause that existed until 2004, and new recordation requirements.

But one aspect of the program the committee is not ready to bring to the MALPF board, one that has cropped up repeatedly over the years is lot rights. Following failed legislation in the 2010-2011 legislation session, the difficult issue of how to accommodate a farm family’s need for dwelling sites is back on the front burner for county-level program administrators who are wrangling with the issue.

Current law, enacted in 2003, allows landowners at the time of application to choose either one unrestricted lot right or up to three lots restricted to family members. A bill supported by MALPF in Maryland’s last legislative session, which passed the House but not the Senate, would have discontinued MALPF’s longstanding lot rights law that differentiated between family lots and unrestricted lot allowances. HB 209 would have allowed landowners to elect up to three unrestricted lot rights, with the number allowed determined by farm size, and with easement values affected.

Lot rights have caused administrative as well as legal headaches for MALPF, sometimes caused by continual changes in the law. In Dec. 2009 the Maryland Court of of Appeals ruled that a Kent County landowner’s right to subdivide a lot is governed by the deed of easement, and not by legislative changes affecting lot rights on preserved farms. The owner was not allowed to sell a lot to a third party, because his easement was settled prior to the 2003 change in the law that allowed landowners that option in lieu of family lots.

The bill would also have significantly altered MALPF’s handling of lot rights, in that lot rights approved would run with the land, and not be restricted to the original seller of the easement. The number of lots allowed was limited by the size of the property: one lot for parcels between 50 and 149 acres; two lots for properties between 150 and 249 acres; and three lots for properties of at least 250 acres. Reserved lots would have been taken into consideration in the appraisal of fair market value and determination of easement value.

Baltimore County preserved farmland (FPR photo)

Baltimore County and Montgomery County opposed the bill, claiming it favored large farms and could compromise the accomplishments of counties that have stricter agricultural zoning.

Fifteen county program administrators met July 7 to discuss the lot rights issue. A number of counties agreed the proposed change would be problematic. Others were more neutral about it.

“For a lot of counties it wasn’t an issue,” said Anne Arundel County program assistant Billy Gorski, who attended the meeting. The change wouldn’t affect Anne Arundel’s program by much, he said. Gorski said one change that would be beneficial, if the child lot law was retained, would be to extend eligibility for child lots to grandchildren. “It should be generational – it could be a grandchild that is coming back to farm.”

Eric Seifarth of Washington County said he could sympathize with the Baltimore and Montgomery County standpoint, that effective agricultural zoning might be compromised.

“Generally we are not impacted to the degree Montgomery and Baltimore counties are, since we have more lot rights than they do,” Seifarth said. “For Washington County there is no difference between a family, tenant or man-in-the-moon lot right. They are all the same. The lot reservation penalty is paid up front and we’re done.” Seifarth observed that lot rights under the MALPF program have been “endless hassles and administrative grief,” unlike in Maryland’s Rural Legacy Program, which concludes lot right negotiations up front, the outcome HB 209 aimed to achieve for the MALPF program.

Wally Lippincott, Baltimore County program administrator, said he and John Zawitoski of Montgomery County held an initial meeting on lot rights with other counties on June 1. According to Lippincott, “other counties did have concerns and [thought] it would be worthwhile to come up with an alternative that would maintain the flexibility of the current system, not discriminate against counties with restrictive agricultural zoning, reduce the number of lot rights proposed in HB 209, simplify the process, and reduce potential work load on state staff.”

Zawitoski said HB 209 “caught many counties by surprise and they didn’t have time to properly vet their positions.”

Central Maryland 2011 straw harvest

Legislation that will likely be drafted for the next legislative session will seek the elimination of the program’s District agreements has been underway since 2007, but some tweaks are needed to eliminate all reference to districts in policy and legal documents. Districts, which were a property designation, were long the first step to become eligible for selling development rights to the program. Six counties retain districts because they are providing property tax credits in exchange for the development restriction the district agreement secured.

The Foundation will likely seek legislation to require two appraisals rather than the current requirement of one, to be paid by any landowner who succeeds in having their easement terminated under the program’s former 25-year buyback provision. Termination requests for properties that were preserved before the legislature rescinded the buyback clause in 2004 require the owner to prove a property can no longer be farmed. The arduous termination process, if completed, ends with a vote in the Maryland General Assembly. No landowners have come forward with a termination request.

Still under discussion for the legislative committee is revising real property law to allow entities that hold easements to record notice in the land records about the easements they hold. According to a memorandum from legislative chair Bernard Jones, “the ability to record these notices in the land records will reduce administration and stewardship costs because these notices will help insure that landowners know if a property is under conservation or preservation easement.” It is thought violations will be curtailed by the change.

Battlefield farmland object of development truce

BY DEBORAH BOWERS

Cedar Creek Battlefield (Google Earth photo)

NEW MARKET, VA – A 174-acre farm platted for 218 homes, and part of the Cedar Creek National Historical Park near Middletown, Va., might get a new lease on life through the Shenandoah Valley Battlefield Foundation.

“We now have an option to purchase the property or to preserve it with an easement if we are successful and it will remain in farming,” at least for the foreseeable future, said John Hutchinson, Foundation director of preservation and planning. Hutchinson said one approach the organization may favor is to purchase the property outright, place it under easement and “roll it over to the private sector,” he said.

The Foundation is studying the feasibility of acquiring the property, known as Island Farm. Hutchinson said a change in town leadership in Strasburg now favors preserving the property. The former town council approved the development as proposed. A changed economy has given preservation another chance, Hutchinson said.

Haying in Shenandoah County, Va. (FPR photo)

“We’re looking at a lot of options and we have strong support from the localities and communities.” Applying for help from the federal Farm and Ranchland Protection Program could be one of those options, Hutchinson said.

The towns of Strasburg and Shenandoah County have each pledged $15,000 to help with the costs of the project. The owner has pledged $10,000 to help the project succeed.

Congress created the Shenandoah Valley Battlefields National Historic District, which includes the Cedar Creek Battlefield, in 1996. The District encompasses Augusta, Clarke, Frederick, Highland, Page, Rockingham, Shenandoah, and Warren counties and the cities of Harrisonburg, Staunton, Waynesboro, and Winchester.

The Foundation, which is the managing entity for the District, works with landowners and other partners to protect Shenandoah Valley battlefields and the historic character of the region, a tall order with Interstate 81and mountain-high signage running through the valley north to south. The focus is on the 21,000 acres that have somehow retained historic integrity on the 10 designated battlefields. The Foundation has collaborated with local governments and other entities in fee and easement projects. The Foundation also works with local governments to improve planning and preservation to insure the survival of the battlefields.

An early and great planner – William Penn

BY MICHAEL MCGRATH, Contributing Editor

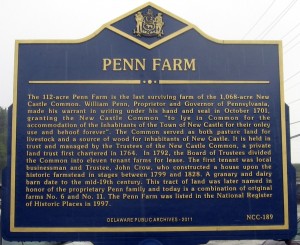

Historical marker at Penn Farm (Photo-Mike McGrath)

In 1701 William Penn first laid out the farms surrounding his new town of New Castle. Then, it was part of his colony of Pennsylvania (later the Three Counties would become the new State of Delaware on June 15, 1776 – now known as Separation Day). Wisely, Penn planned for the resource needs of the colony by setting aside over 1,000 acres of land as a trust in common, as he stated in his charter, “to lye in Common for the accommodation of the Inhabitants of the Town of New Castle for their onley use and behoof forever.” And it wasn’t just benevolence that motivated Penn.

Penn, and his Quaker brethren, came to America to find freedom. Their brand of freedom was rooted in strong religious convictions, but they were also motivated by bitter experience. These religious dissenters had been hounded and persecuted in their native land. They knew that real freedom was necessarily rooted in more than noble words and stubborn opposition, but would have to be founded on true independence from that system of commerce and

William Penn

government that sought to control all the aspects of their lives. Penn, unlike other founders of American colonies, knew that resource independence was a vital component of colonial success. The “Common” he established for New Castle was to provide for that independence. In documents we find that wood was a vital resource from those lands for both construction needs and energy resources for heat and cooking. Later, farming would provide the food and fiber for the sustenance of the town. Recently I’ve been a part of a major project to rekindle the vision of William Penn in the 21st century.

The Trustees of New Castle Common continue to this day as a vital force in the life of the Town of New Castle. ( http://www.newcastlecity.net/city_gov/trustee.html ) The last remaining farm of the Common established by Penn has become the focal point of a new project to update Penn’s vision for today’s world. In conjunction with Delaware Greenways, Inc. the Trustees are revitalizing the farm, restoring the old house and buildings, have opened a farm market (Tract 6 Market, after the survey number of the farm from 1701) and will be establishing a CSA and several cooperative programs of education and training with the local school district. In short they are bringing back Penn’s idea of farmland in support of the prosperity of an urban center.

And we all thought the trends of local food, supporting local agriculture, and linking farms to community were something new we had thought up! Not really – these ideas are more than 300 years old! There will be good, fresh food for the residents of New Castle coming from land preserved in common for their benefit. People can once again walk (or ride bicycles) out to the Penn Farm, talk to the farmers, enjoy the views – and take home dinner! But as great as all this may be, there’s more to the update of Penn’s plan than just some fresh corn! There’s the matter of independence.

In the last 10 years or so we’ve learned from bitter experience the costs of dependency. Most dramatically, dependence on others for our energy resources has cost us our wealth and the lives of our country’s youth. More importantly, our own belief system has been assailed and assaulted by those who hold us hostage by their control of petroleum.

We could stand on the verge of another pernicious web of dependency surrounding our food and agricultural products. As we let more and more of our country’s farmland slip away the specter of greater dependency on foreign food supplies becomes more real. William Penn would warn us sharply about such dependency. Penn would counsel that we set aside land, preserve it for the future health and happiness of our communities, for our “onley use and behoof forever.” Penn would tell us that if we want to pursue our own quest for freedom and independence as a nation in the 21st century, we must also pursue our independence in food and resources.

That still sounds like good advice after 310 years!

Delaware launches program to help young farmers buy land

BY DEBORAH BOWERS

DOVER, DE – Delaware Gov. Jack A. Markell signed into law the Delaware Young Farmer program during the Delaware State Fair in July and used the occasion to promote the state’s efforts at securing a future for farming for Delaware’s 2,500 farm families. This year Delaware committed $10 million to farmland preservation, with $3 million targeted to the new Young Farmer Program, which helps beginning farmers purchase land that is put into conservation easement.

Delaware Gov. Jack Markell at the bill signing for Young Farmer Program

Delaware farmers generate $1.2 billion in annual sales. Over the last 20 years the state farmland preservation program has preserved more than 100,000 acres, about one-third of the state’s farmland.

“At this year’s fair, we celebrated our renewed commitment to agricultural preservation and the launch of our Delaware Young Farmer program – providing incentives for young farmers to carry on family farms and start-up farms of their own,” Markell said in his weekly address. “We will help young farmers acquire land, and at the same time, be providing for the permanent preservation of that land.”

“Farmland is one of the wisest investments we can make to grow jobs and opportunities – while saving our future costs and sending a signal that we’re investing in agriculture for the long haul,” Markell said. “We know the dream of so many young Delawareans is to grow up to be like their parents or grandparents and become farmers. It is our job to facilitate that dream.”

The Young Farmer Program, developed by former farmland preservation director Mike McGrath before he retired in June, was provided for in the FY 2012 budget. It is designed to reduce the capital investment for young people who want to start an agribusiness and sets up an affordable repayment program for them. The land a young farmer purchases will also be permanently preserved through the Delaware AgLands Program.

Markell also promoted the state’s farm markets and state’s Delaware Fresh smart phone application for locating fresh produce.

Delaware ranks 9th nationwide in the percentage of land area devoted to cropland. Thirty-five percent of Delaware’s land mass is devoted to cropland, 42% of our land is in farms.